I Don't Like Layer 2 Anymore

I had been quite vocal about Optimism on Twitter when it was trading at north of 5bn FDV back in June last year with a view that this red coin is criminally undervalued.

Optimism was casually printing more than 40mn in annualised top line fees and had just announced the Superchain vision in which chains opting in this ecosystem would be paying Optimism sequencing fees or profits. In other words I will be paying roughly 5bn for an ecosystem of chains including Base and the OP mainnet itself.

As the EIP 4844 upgrade approaches and is expected to happen on 13 March 2024; Optimism as the direct beneficiary has significantly surged in value and is currently trading at north of 15bn. Hence I think it’s high time to review the original investment thesis as major catalysts are playing out.

The more I think about the incremental upside Optimism could further garner; the more skeptical I become. Don’t get me wrong - I think Optimism together with the OP stack and the broader Superchain ecosystem have become an important piece of infrastructure in the Ethereum ecosystem. The $OP token could still do well this cycle; but I still have a few big question marks on layer 2 as a whole:

layer 2 valuation has a theoretical “glass ceiling”

The simple way to put the relationship between Ethereum L1 and L2 is that Ethereum L1 secures activities on L2. As a natural extension to this point layer 2 collectively should not be more valuable than the Ethereum L1; because the Ethereum consensus mechanism provided layer 2 authenticity of what had happened. And it doesn’t make sense for a cheaper chain to be securing activities happening on more expensive chains; otherwise why would L2 even be settling on this base layer?

Theoretically L2 or even L3 could settle on any blockchain and it is ultimately a function of which features those blockchains would like to inherit. For a layer 2 to settlement on Ethereum L1; the blockchain is opting into the security offered by the consensus mechanism by the Ethereum validators; the liquidity Ethereum has already amassed and the bridge which is also secured by the Ethereum consensus.

This coming in assumption should be considered as true unless “settlement layer as a service” becomes more commoditized in this cycle with the emergence of the likes of Dymension or that other general purpose layer 1 could offer the same set of features Ethereum L1 is currently offering as aforementioned.

The counter argument to this “glass ceiling” problem is that if any layer 2 manages to take off massively in a way that it onboard the next millions user; the value accrual could eventually trickle down to the Ethereum base layer which would effectively lift the said “glass ceiling”. My only skepticism towards this perspective is that

given the valuation Ethereum (i.e. 330bn FDV) is currently trading at; I feel like it’s extremely hard for crypto native money alone to push Ethereum a certain level. It requires massive inflows of external money (e.g. could be from the ETH ETF hopefully) for Ethereum to trade above some of the valuation target we have for it this cycle

“demand for security” or “moneyness” is still a relatively nascent idea within the fundamental crypto investors circle; and it requires this school of thought to be the overarching framework when it comes to investing in infrastructure

value accrual from layer 2 back to layer 1 is often slashed by more than an order of magnitude in terms of fees; this problem is worsened after the implementation of the EIP 4844 upgrade where the cost to post data back to Ethereum is effectively reduced by more than 10x - not to mention layer 2 batches multiple transactions and therefore it requires more than 10x for fees paid to Ethereum to do a 10x

the layer 2 war is cannabalistic in nature

According to the above logic; the collective TVL on layer 2 is always going to be a subset of the entire TVL on Ethereum because layer 2 choose to settle on Ethereum partly due to the deep liquidity. And by having a bullish bias on one single layer 2 tokens; we are basically making a few assumptions as below:

ETH TVL would still double or triple from here and in the more optimistic case one is assuming that it would do a multiple from the current level

ETH TVL is currently at north of 40bn and that peaked at north of 100bn in the previous cycle; and it requires ETH TVL to be triple of quadruple of the previous peak for every layer 2 to have enough TVL and be traded at tens of billions of dollars; offering enough upside for the investment to be interesting

collective layer 2 TVL as a subset of ETH TVL will continue to grow

considering major layer 2 including Optimism, Arbitrum, Polygon and the newly minted ones such as Manta and Blast; the % of collective layer 2 TVL is currently at north of 20$; and by investing in layer 2 one is making the assumption that this % could at least do a multiple of that

back in January 2023 when there are only 3 “rollup” in the market this ratio is at roughly 10%; and fast forwarding to January 2024 the market has more than a dozen of general purpose rollups but this % has merely doubled meaning the average TVL per rollup has been decreasing

as an extension to that - the layer 2 that you like (e.g. Optimism or Arbitrum) somehow manages to get more TVL than the new and shiny gigantic farms (e.g. Blast or even Manta)

Given the above 2 structural reasons; I have turned slightly less bullish on layer 2 as a sector. I think individual layer 2 could still do well - but it would more be a function of idiosyncratic reasons instead of the sector taking off as a whole and would eventually trickle down to all layer 2 in general; two examples that I could think of include:

Optimism - $OP could still do well as a proxy bet on the entire superchain ecosystem where investors are betting on Base eventually onboarding the next millions retail users given the proximity to Coinbase or that Farcaster manages to beat Twitter and become the de facto crypto social applications

Polygon - $MATIC or $POL could go parabolic if the institutional partnerships takes off with the likes of Astar in Japan or Nomura/Brevan Howard in traditional finance; or that the zero knowledge proof powered aggregation thesis plays out handsomely and enables atomic interoperability across all zkEVMs

I just find it hard to imagine a universe where one single layer 2 could beat the rest only by being extremely good in business development and end up onboarding all tier one crypto native partnerships like games and defi protocols - if not what should we even be bullish and be investing in any of the layer 2?

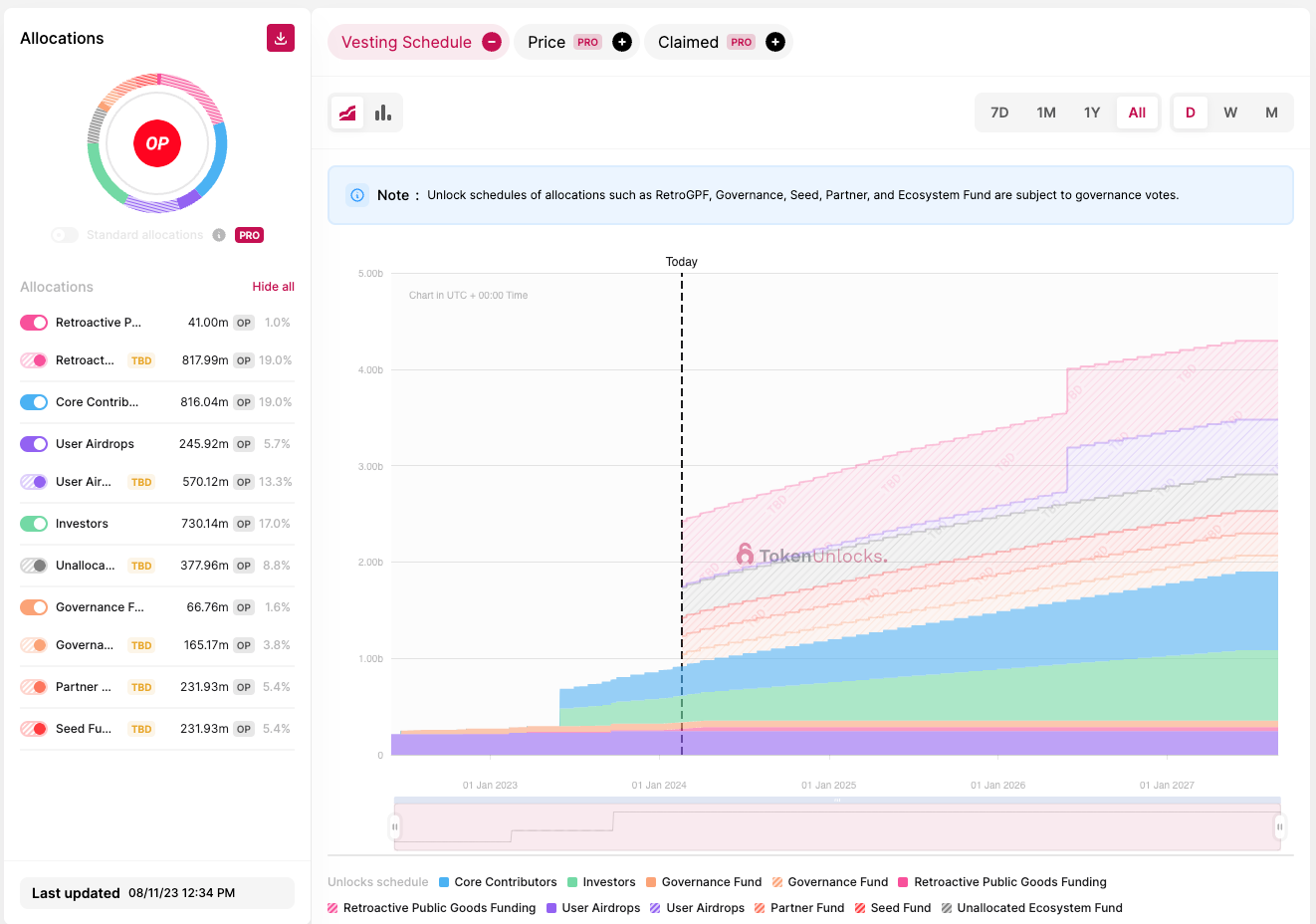

aggressive token vesting schedule

Another important factor to keep in mind is the aggressive vesting schedule these new layer 2 have in the coming cycle. This is also why I have bullish bias on older coins such as Optimism and Polygon in this context since they have already gone through the steepest part of their vesting schedule; and of course this has partly been reflected in their relatively compressed valuation in hindsight.

the aggressive monthly unlocking of $OP tokens has always been the Achilles Heel of the token price; but like I said the incremental selling pressure would be tapering relative to the circulating market cap going forward

the $MATIC tokens are almost done vesting and by migrating to the $POL token it would only be subject to 2% annual inflation going forward which is considered reasonable relative to other PoS chains out there

On the other hand some of the relatively newer layer 2 tokens will finally start unlocking in the coming months. Given how heavily funded these chains are and the valuation that they have raised their previous seed and private rounds at; it is not hard to imagine that venture capitalists are dumping in market without any hesitation.

only 12.75% of $ARB tokens are currently circulating; and a massive cliff unlock of more than 1bn tokens will be happening on 15 March 2024. This would then be followed by monthly unlocks of more than 90mn tokens until 2027

it also seems quite apparent that the Starknet team cannot wait to dump $STRK in the market on retail users after years of building (merely nothing) judging from the way they design the token’s vesting schedule - i am an e-beggar too myself

money printing for business development

What is worse is that on top of the aggressive unlocking schedule; layer 2 projects could not help but keep giving out their native tokens to incentivise and seal partnership deals. After all the underlying technology only matters so much that business development has become the key differentiation factor in this race.

We have witnessed how the Polygon has been giving out grants in terms of $MATIC and sealed impressive partnership with the likes of Disney, Meta and Starbucks. But that has resulted in massive selling flows in their tokens and explains how $MATIC has been trading very cheaply relative to other newly launched layer 2 with weaker business development efforts.

At the same time, we also begin to see early signs of Optimism and Arbitrum giving out tokens to retain users when gigantic farms such as Blast or EigenLayer are offering much better risk rewards to mercenary money in the ecosystem.

Optimism had done 3 rounds of Retroactive Public Goods Funding and collectively given out 40mn $OP (which is equivalent to >150mn) tokens to projects building within the ecosystems and leveraging the OP stack

Arbitrum also had run rounds of short term incentives program and given out more than 71mn $ARB tokens to projects; and is even considering establishing an 200mn gaming focused ecosystem funds and a longer term incentives program to continue propelling users activities

It is reasonable to assume this aggressive incentivization would only continue in this cycle until the layer 2 competition sees a clear winner and until then I think layer 2 as a category in general is going to lag in price performance.