With the recent launch of the Celestia token and the migration of the leading perpetual futures exchanges dYdX; the Cosmos ecosystem is no longer a lull. DeFi activities started to pick up with better liquidity as the consortium of sovereign blockchains also welcomes the launch of native USDC and USDT.

As the de facto liquidity hub of the Cosmos ecosystem; Osmosis conceivably becomes one of the largest beneficiaries of the comeback. The investment case of $OSMO is compelling as it is not only a trade capturing the revivals of Cosmos app chains; but also the significant protocol upgrades have signaled a re rating opportunity.

Introduction of Osmosis

Osmosis started off as an DEX app chain back in July 2021; and it very quickly emerged as the de facto liquidity hub across the entire Cosmos ecosystem. Osmosis generated >100mn in daily trading volume on average; and amassed >1.7bn in total value locked during its peak in early 2022.

The entire ecosystem took a hit when Luna went down in May 2022; and subsequently comes the bear market; but during which the Osmosis team continued to build and has since then shipped multiple interesting product features that further improved the user experience and more importantly the unit economics of liquidity providers

superfluid staking; which allows liquidity providers to collect staking rewards while simultaneously offering liquidity in the Osmosis AMM pool

supercharge liquidity; which is basically a concentrated liquidity pool design allowing liquidity providers to pick their preferred price range instead of offering liquidity to the entire liquidity curve enhancing capital efficiency

Osmosis also worked with closely with Skip Protocol, a team building infrastructure for sovereign protocols and primarily for Cosmos app chains; to develop some interesting features that are accretive to the protocol

fee abstraction module enabling users to pay fees on Cosmos Hub with any tokens; and swapping happens seamlessly under the hood routing through Osmosis bringing passive trading volume to the protocol

protorev and PoB module; which captures cyclical and on off chain MEV respectively and accrues back to Osmosis stakers

The most critical and material change to the protocol is that Osmosis turned on the protocol taker fees on 13rd October this year. It means that every transaction that goes through Osmosis would now bring fees to the protocol and its stakers directly.

The proposal is widely considered as necessary but the community is concerned with the implementation as it could potentially impact the unit economics of traders and cannibalizes trading volume. The Osmosis community even formed a sub DAO to oversee the implementation of the plan; and decided to start with taking 10 bps from each trade; and this is going to be the centre of the re rating opportunity.

Thesis #1 - Re Rating Trade w/ Fat App Chain Thesis

I would argue the market never knows how to price sovereign app chain properly or which multiple to apply to them in general given how the infrastructure is designed for only one use case but at the same time inherited all the features and functionality of the blockchain stack.

On paper Osmosis had historically been very similar to other decentralized AMM such as Uniswap before the protocol fees are turned on. These AMMs are facilitating tons of swap trading volume every day but all of the value generated by the application would eventually flow to liquidity providers without clear value capture by the application itself.

That being said Osmosis actually does way more than creating a venue for token exchanges. Osmosis takes care of the app chain’s consensus mechanism and the $OSMO token even serves as the incentives for stakers and validators to offer security to on chain activities and assets.

Hence the market has been struggling to properly assign a reasonable valuation to Osmosis; and the lack of liquidity during the bear market makes justifying the valuation an even tough task

on one hand one could argue that $OSMO should be trading closer to the fees multiples of pure play AMM like Uniswap which is closer to the single digit range

on the other hand one could justify a slight premium to that or even the multiple of the trading alternative layer 1 or layer 2 which is outrageously high at 200x.

Now that the protocol is turning on the protocol fee switch; it nudges the market to properly price this token according to the fee that are earning and the multiple that a proper base layer with an ecosystem of application built on top of it should demand.

Not to mention Osmosis is a vibrant ecosystem with 10+ applications built on top of it including some important DeFi primitives which could therefore also easily justify the multiple of a base layer including the below

Mars Protocol: borrowing and lending protocol and also offers leveraged staking with borrowed funds

Levana Protocol: perpetual future trading platform that offers up to 30x leverage

MarginFi: offering “power perps” which gives traders exposure to the "square” of an asset’s underlying price

Thesis #2 - Cosmos Revival Play

The bear market consolidated Osmosis’ status as the nexus of liquidity in the broader Cosmos ecosystem; and as aforementioned the team has been relentlessly shipping new features which smoothen users’ experience interacting with the application

As value accrual is now a function of swap trading volume after the implementation of the protocol’s taker fee; multiple growth levers would continue to propel the growth on Osmosis and bring more trading volume and fees to the token

fee abstraction developed by Skip Protocol as mentioned would bring more passive trading volume as swapping would be routed through Osmosis’ liquidity without users even noticing

native USDC and USDT pairs inducing more liquidity providers; previously tokens are usually paired with the $OSMO which introduces more risks of impermanent loss and this would be improved by stablecoins

more heavily venture funded chains launching on Cosmos such as Namada, Berachain and Anoma; and those chains are also expected to bootstrap liquidity pool on Osmosis like how Celestia and dYdX did to bring volume

liquid staking module effectively doubling the token pair universe given how DeFi users are seeking for solutions with better capital efficiency; the likes of stATOM / ATOM and stOSMO / OSMO are already listed and the more highly anticipated pairs like stDYDX and stTIA would be next in line

Other than the aforementioned growth levers; Osmosis also have partnered with Celestia serving as the ecosystem’s liquidity hub. Trade routes could be established with the help of interoperability protocol Hyperlane; suggesting Osmosis could also passively capture the growth of the Celestia ecosystem as rollups start to be launched.

Some Thoughts Around Valuation

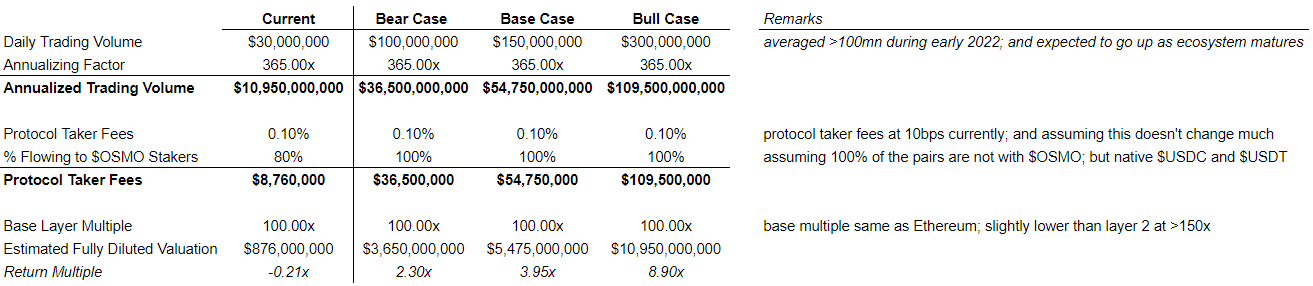

The valuation of the Osmosis token follows a very simple fundamental mathematical formula; which is the annualized trading volume * protocol taker fees * fee multiples and let’s break this down one by one

annualized trading volume: currently Osmosis is doing a daily trading volume of 20mn to 30mn; and annualizing that would give us the range of 7bn to 10bn; and during its peak in early 2022 Osmosis sees a daily trading volume of >100mn

protocol takers fee: currently set at 0.1% and token paired with $OSMO would have the takers fee flowing to a community pool instead of stakers and the current ratio of that is at 80%; this should trend towards 100% in the long run as most token pairs would be paired with native USDC and USDT

fee multiples: base layer trades at a wide range of multiple currently; Ethereum is trading at close to 100x and layer 2 slightly higher at 150x to 200x and alternative layer 1 is even higher at 300x to 500x; not to mention fee multiple often when the market becomes a bit more euphoric

There are also other moving parts in the calculation that I have not factored in for simplicity; but the brief idea is value accrual should be a function of swap trading volume and the market is to continuing pricing Osmosis as a proper ecosystem

The upside should be more lucrative if we factor in other fee contributing factor such as the protocol revenue module and the upcoming Skip PoB module; and these two source of revenue should contribute a higher % of fees to the protocol as liquidity improves and some of the Cosmos tokens get listed on centralized exchanges.

The downside risk of this model is if the protocol taker fee is squeezed as competition matures in the Cosmos ecosystem with the emergence of Neutron and Kujira.

Also as aforementioned subDAO is also formed to monitor the trading volume of stable swap pairs to see if the take rate of 10 bps would make sense going forward and therefore the net protocol taker fees should trend downward in the longer run.

Conclusion

I still believe that Osmosis at the current presents an interesting opportunity with massive upgrade as suggested. With some of the more exciting catalysts such as the emergence of the Celestia ecosystem tokens; and other highly anticipated VC funded chains like Namada, Anoma, Berachain; Osmosis is poised to strong growth into the bull run