The Price of Modularity

Introduction

Celestia just dropped 6% of the token supply to the early contributors and users of the network; and the token is already trading at more than 2bn valuation on Aevo. As the first blockchain built specifically for data availability, it seems tricky to properly value it since literally nothing is built in the same way as they do in the market.

Messari also recently dropped a piece trying to triangulate the fair valuation of Celestia with the amount of data users have to pay for in order to justify the current price tag of more than 2bn.

In this article I would like to share the way I think about the valuation of Celestia and the logic; and why I thought it could be delusional to value Celestia from a standalone fee perspective. As always I would love to exchange thoughts on this subject matter and hope my perspective would be interesting.

How Modularity Works

Celestia splits the three components of a blockchain (i.e. execution, consensus and data availability into different parts; within the ecosystem rollups take care of the execution of transactions and the base layer handles the consensus and data availability of the said transactions.

The closest comparable in the market is Ethereum and its rollups; in which the Ethereum base layer handles data availability and consensus of the network while the likes of Optimism and Arbitrum are in charge of the execution of transactions.

The only difference of the two designs is where transactions are settled. On Ethereum transactions are settled on the base layer whereas for rollups on Celestia transactions are settled on the sovereign rollups themselves. However settlement is more a byproduct of data availability since as long as a chain is able to prove transaction data exists somewhere on the chain could it justify the sequence of transactions settled.

Valuation of Ethereum and Rollups

A logical approach to triangulate the valuation of Celestia is to take a page from how the market is effectively pricing Ethereum and its rollups; and as an extension to that the relationship or ratio of the said valuation.

Ethereum currently trades at close to 180bn; while collectively all rollups on Ethereum add up to close to 30bn including those that are not publicly trading yet such as zkSync, Scroll and Taiko.

Imagine in a universe where Ethereum only serves as the base layer of the rollups and we strip away the valuation of Ethereum that serves activities on the base layer itself according to the level of TVL; the base layer could be worth roughly 20bn. According to this logic; if the market prices the rollups on Celestia at 1.5bn collectively; Celestia should follow the same ratio as above and be trading at 1bn.

The problem with this method is that the logic points us to a conclusion where the value of the base layer would reduce relative to that of rollups when there are more rollups built on top of the layer; but this does not stand since theoretically speaking the base layer should be more valuable when there are more chains built on top of it.

Fees of Ethereum and Rollups

An extension of the aforementioned approach is to look at the fees paid by rollups to the Ethereum base layer for data availability and the fee users paid to rollups for the execution of services; and hence their relationship and ratio.

Ethereum rollups are currently paying an annualized fee of 65mn to the base layer for data availability; and users are paying more than 100mn to rollups for executing transactions. A logical extension to that would be pricing the two layers according to FDV / Fees multiples as the Messari report has suggested.

It sounded logical to think that Celestia and its rollups should follow a similar pricing ratio as suggested by the market but this would require the market to price modular blockchain at an outrageously high trading multiple to make up for the low data availability fees they are offering; which might not be entirely logical.

Who Is Paying For What?

Don’t get me wrong - the above relationship and analogy still stands and I still do think they are the closest comparable we could find in the market as a reference point to properly value Celestia.

We know that the execution layer is valuable because users are willing to pay a specific sum of money to execution transactions; and we also know the data availability layer is worth billions of dollar since rollups are willing to pay them for storing data; but the availability of data of transactions happened on the chain is only made possible by validators that offers the network with consensus.

If we consider fees as an accurate estimation of how much each layer is worth; we should also factor in the value paid to validators for offering consensus to the network; as they are incentivised by the network’s inflation or issuance of native tokens to stake assets and secure the network. In other words the network is indeed paying validators for them to provide consensus.

Now that we know who is paying for each component in a modular world; users are paying for execution on rollups; rollups are paying for data availability to the base layer; and the network is paying validators for consensus; we could now apply a similar logic as above to see what is the sum of money paid to each component of the modular blockchain universe.

How Much Is Paid For What

As aforementioned, Ethereum rollups are currently collectively paying an annualized fee of 65mn to the base layer for data availability; and users are paying more than 100mn to rollups for executing transactions.

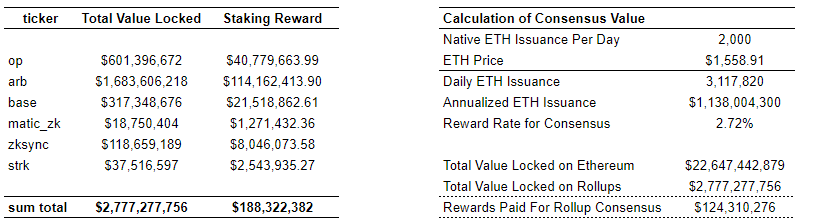

The Ethereum base layer is currently also paying validators more than 1.1bn in annualized reward to secure the network; assuming ETH trades at current level of 1.5k. Although validator rewards also come from other sources such as maximum extractable value and tip fees; in this calculation only native ETH issuance is considered since it is a better reflection of how much the network is willing to pay for consensus itself; and other revenue source is a function of execution and activities in the network.

We could then split the portion of the validator reward issued to secure assets on rollups and the base layer according to the total value locked; assuming that TVL is a crude but accurate metric to reflect the value of the network. TVL on Ethereum base layer is currently at close to 23bn while that on major rollups is only close to 3bn.

We would then end up finding Ethereum is paying more than 120mn per annum to offer consensus for the rollup layer; this should theoretically grow as adoption of layer 2 increases as a function of increasing TVL being migrated to rollups.

From the above calculation; we would find out that users are paying rollups more than 50mn for execution of transactions; while rollups pay the base layer 65mn for data availability and the base layer pay validators 120mn for consensus and security.

We could eventually come up with a ratio of 3.6 to 1 for the service offered by each layer and the value paid for the base layer and the execution respectively. What this effectively means is that for every 1 dollar users are paying for execution on rollups in the Ethereum ecosystem; 3.6 USD dollar is paid for data availability and consensus in the base layer.

This ratio of 3.63x is a rather static view and crude estimation of how the market is pricing the data availability plus consensus layer of a modular chain as of now; and should theoretically be moving according to the price of the underlying asset.

Valuing Celestia

Let’s improvise here and try to make the above analysis useful - since most Celestia rollups are not live yet it is extremely hard to assign a fair valuation to the ecosystem; but we could play around with assumptions and numbers to triangulate the valuation.

Now we know in the Ethereum ecosystem for the system to function properly for every 1 dollar paid for execution; 3.6 dollar will be paid for data availability and execution on the base layer. So the first step is to find a close estimation of execution fees paid by rollups in the Celestia ecosystem.

Assuming there is one Arbitrum equivalent rollup in the Celestia ecosystem that has a daily transaction count of 500k; and that rollups price their execution gas fee as a function of data availability cost. Theoretically speaking data availability on Celestia should even be more competitive than that on Ethereum after the EIP 4844 upgrade; and effectively users on Celestia’s rollups should be paying less than 0.02 USD assuming rollups is running with an operating margin of 75%.

Sovereign rollups have very different and special ways to accrues value from activities as we have witnessed in the Cosmos ecosystem; let’s just say this way of pricing links the two side of the equation and make the assumption more grounded as we are playing with assumptions after all.

If the above ratio in the Ethereum holds also in the Celestia ecosystem; it translates to a 8.9mn required to reward validators in the Celestia network as a base line. Assuming Celestia runs in a reward rate of 5% to 7% like other Proof of Stake network and only 10% of the total supply is staked to secure the network during the early days of the network; this would gives us an valuation range of close to 1.2bn.

Of course this is a crude way to backward engineer the valuation of Celestia according to what we see in the market; and what is all means is that it takes on Arbitrum equivalent rollups for Celestia to be worth 1bn; and at the same time it takes into account some important logic under the hood

the reduction of data availability fees from future upgrades do not lead to a downward adjustment of valuation of the base layer; and does not make the execution more valuable than the base layer

the more rollup built on top of the layer; the more valuable the base layer become since the base layer offers data availability services to more execution layers; and hence the consensus is worth more as the ecosystem grow

Closing Thoughts and Open Questions

The above method to triangulate the valuation of Celestia is for sure quite creative; and there are still a couple of open questions to be answered before this logic is proven to be solid.

For instance a major assumption I placed in the above around rollup economics assume perfect correlation between data availability costs and execution fees; and the two components are indeed priced by two different market and stakeholders involved.

Also for the consensus cost in the calculation for the staking rewards paid to secure the rollup portion of the Ethereum ecosystem; one could argue total value locked might not be an accurate to separate the two portions; and also consensus fees do not scale linearly with the level of activities on rollups.

That being said the above piece serves as an attempt to logically think of an approach to price data availability and consensus which the market might not be very efficient in assigning the right value yet. Hope the above piece could be interesting!

Great read, ty!

I was lost on the calculations of how much users pay for execution.

In one place you mentioned that «users are paying more than 100mn to rollups for executing transactions»

In the other you said that «we would find out that users are paying rollups more than 50mn for execution of transactions»

Can you clarify this please?

Really interesting. Would love to hear your thoughts at valuing EigenLayer and EigenLayer eco projects like KelpDAO. https://defillama.com/protocols/Infrastructure