Tough Sell

Bridges are playing an increasingly important role in today’s on chain economy as more newly minted layer 2s and alternative layer 1 are launching. Third party bridges or what we call token bridges solve one of the most technically complex issues in crypto as interoperability and cross chain connectivity become more important.

Although more value is supposed to accrue to bridges as an vertical but the price performance of most token projects have been subpar compared to the ETH and BTC; bridges are structurally tough to invest into given how fragmented the market structure is and how slightly different approaches will almost always come with some degree of tradeoffs.

For the purposes of fair comparison; this article would primarily be focusing on token bridges and put less weight on cross chain messaging protocols.

Bridging Market Overview

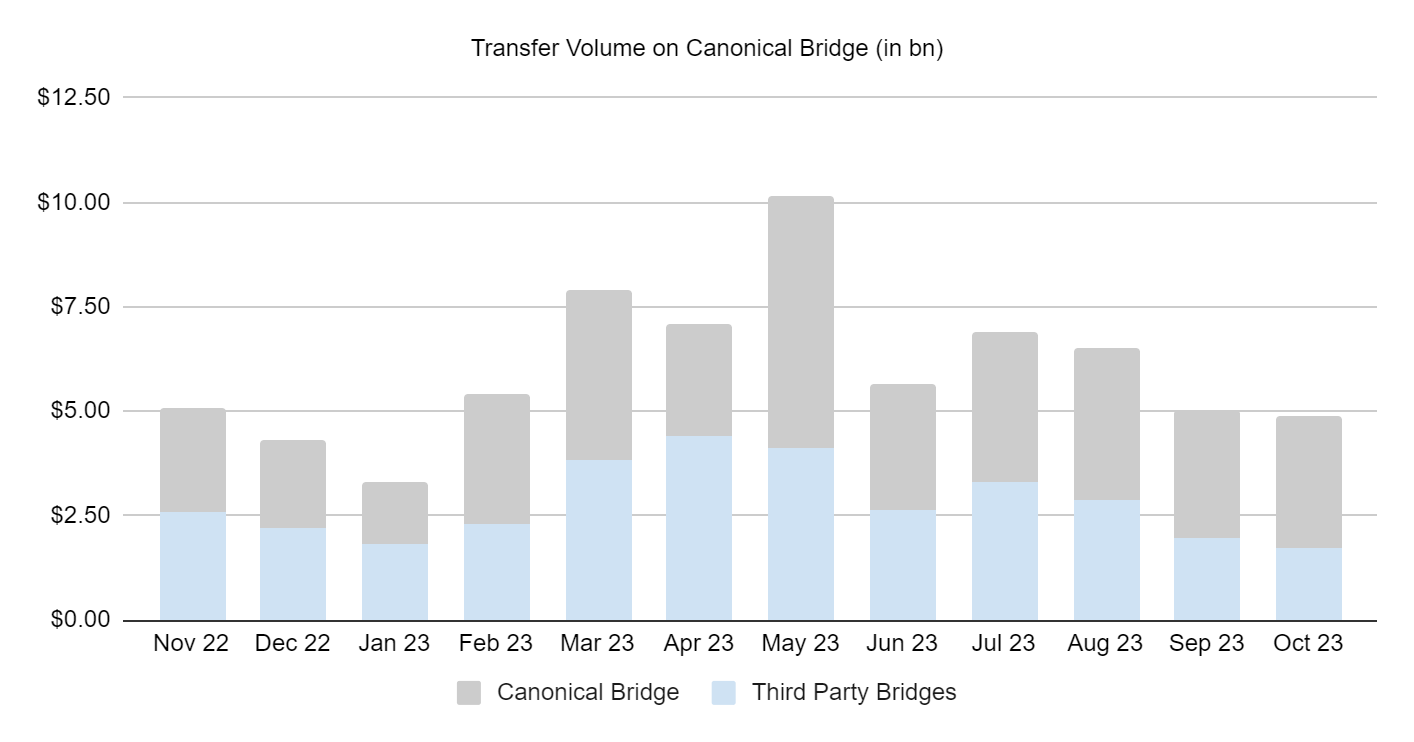

Today the bridging market does an annualized transfer volume of 50bn to 100bn; and is expected to grow significantly as on chain activities ramp up catalyzed by the launch of multiple new protocols. The demand for better connectivity between chains and and the quest to solve for the liquidity fragmentation problem between chains is going to drive more adoption of token bridges as the market recovers.

The current bridging market is primarily dominated by canonical bridges which are generally referred to bridges operated by protocols themselves and inherit the security level derived from the consensus mechanism of their respective base layers.

Canonical bridges have consistently contributed more than 50% of bridging demands over the past 12 months and even sees an increasing trend of increasing transfer volume reaching a staggering level of more than 70% as of last month.

The market generally refers third party bridges as “token bridges”; they are cross chain infrastructure that fronts users with liquidity of the desired assets at the destination chain to shorten the waiting time; some examples include

Stargate Finance which bootstraps liquidity pools on all supported chains; when users send tokens from one chain to another, liquidity pools would front users liquidity from the pools; the protocol would subsequently rebalance themselves

Across Protocol settles transfers leveraging off chain actors; which they offer upfront liquidity to users and are subsequently repay third party relayers by the bridge’s liquidity pool via canonical bridges

The third party bridges vertical currently generates an annualized volume of close to 20bn; with monthly transfer volume retracing from the April high of more than 4bn to the current level of less than 2bn losing more than 50% in absolute terms.

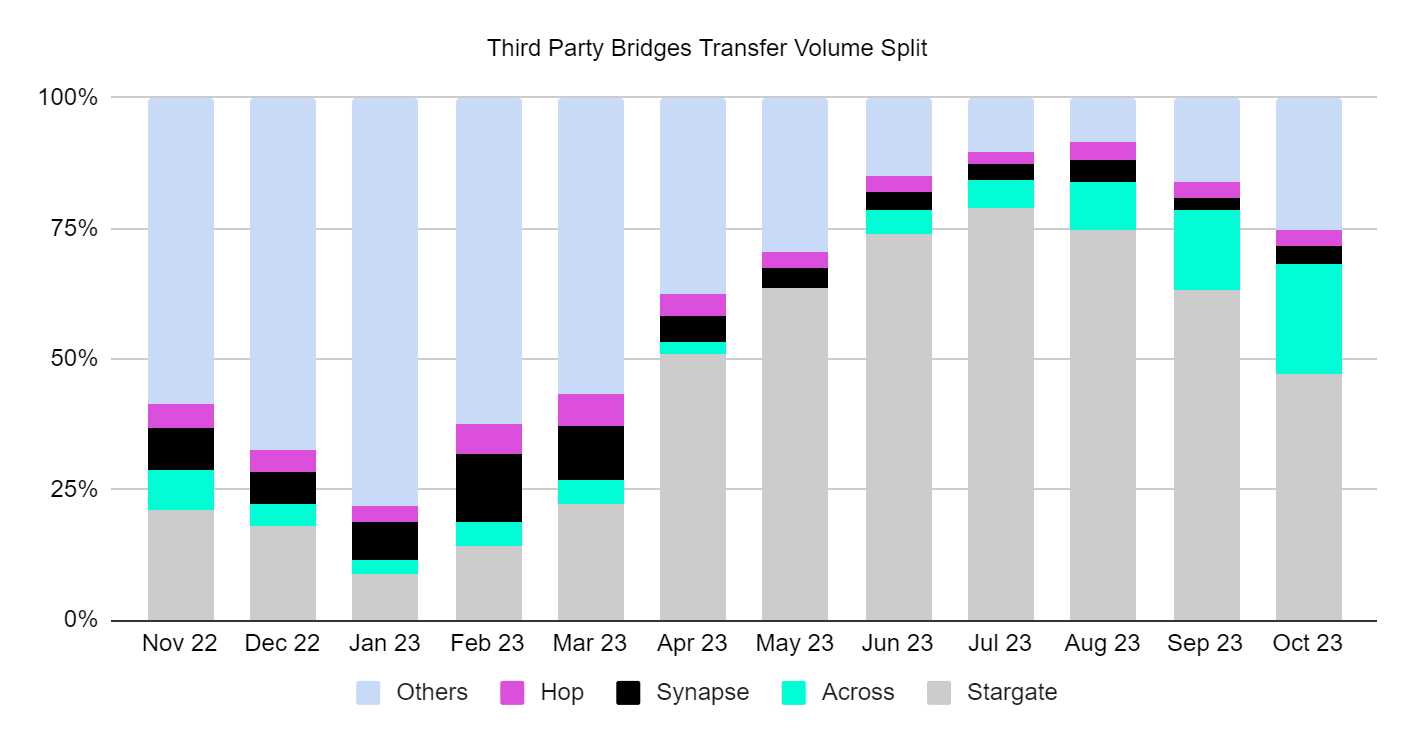

The third party bridges vertical has seen a drastic market share shift after the July Multichain hack; and the launch of more layer 2s has also catalyzed the adoption of liquidity bridges focusing on the Ethereum ecosystem and as of now

Stargate Finance emerges as the absolute market leader with close to 50% market share; slightly retracing from the July peak of more than 75% market share;

Across gaining market share since the beginning of the year with less than 5% to more than 20% as of now given its Ethereum alignment;

legacy liquidity bridges such as Hop Protocol and Synapse have seen market share squeezing from around 10% to the current level of less than 5%

Why Are Bridges A Tough Sell

As mentioned above the dynamic market structure makes investing in the bridging vertical extremely tough and tricky especially with the emergence of newer technologies and bridging alternatives every once in a while.

Over the course of the last two years we have seen different bridges dominating the vertical and subsequently became less relevant to the market as the industry evolves and crypto natives embrace newer narratives

Multichain dominating the vertical with its innovative “mint and burn” mechanism and the widespread support of various layer 1s in the early days of bridging; but has subsequently lost shares and became irrelevant after the hack

Synapse gaining market share since two years ago with its innovative nexus assets (i.e. nUSD and nETH) design; but soon failed to keep up with the level of slippage to more capital efficient bridges such as Stargate and Across

Bridges are generally tricky to invest as they are not only fighting against each other for market share; but also are they solving some of the most technically complex issues in crypto by making necessary tradeoffs while there is no lack of handy alternatives to what they are offering.

The situation becomes more complex when bridges are going to market as they are also limited by scalability issues given how they are designed; and some might even argue security problem would eventually materialize when stakes become higher.

1. Trust Assumptions Bringing Scalability Problem

The trust assumption problem is perhaps one of the most concerned issues when it comes to investing in bridges but in my opinion the least relevant and the most overblown ones as we are only discussing liquidity bridges in general instead of all cross chain messaging protocols.

In a nutshell, bridges face the interoperability trilemma as they could only optimize for two out of the three configurations including trust minimization, generalizability and extensibility.

trust minimization refers to the number of counterparties that bridges have to interact to verify the the transfer of assets or messages; or simply putting who do bridges have to trust for transactions to go through

generalizability refers to the kind of assets bridges could pass; general message passing protocols like Axelar could pass arbitrary messages while liquidity bridges do mostly transfers of tokens

extensibility refers to the number of ecosystems bridges could natively interact with; Synapse connects to most EVM chains while Across only serves rollups in the Ethereum ecosystem as of now

As a natural extension to that; bridges or broadly general message passing protocols would adopt only one of the three verification methods to facilitate the transfer of tokens or message and make necessary tradeoffs to optimize for specific use cases

natively verified bridges including the NEAR Rainbow Bridge which validators of protocols would verify the transactions originated from the counterparty but is generally considered as costly and less extensible

locally verified bridges where counterparties verify each other and enable transfer with limited extensibility such as Hop serving only rollups on Ethereum

externally verified bridges including Stargate and Celer leveraging the crypto economics bootstrapped by third party validators to verify tokens transfers and are theoretically considered as less secure

As a subset to externally verified bridges; optimistically verified bridges face a certain risk of collusion as bridges would assume the message passed to be optimistic unless a fraud proof is submitted in the case of malicious behaviors and for instance

Across as an optimistically verified bridge leverages the UMA optimistic oracle to resolve any disputes; it is ultimately governed by the crypto economics of the $UMA tokens which could be susceptible to malicious behavior when the cost of colluding outweighs the value of the protocol

In reality, users are only interacting with liquidity bridges for 1 to 5 minutes per transactions at most; and the security risks are actually transferred to those who offer liquidity to the protocol be them bonders or off chain actors; which is also the reason why I thought the security problem is slightly overblown under this context.

What the trust assumption problem actually brings is scalability problem. Unlike all other established verticals in DeFi in which the market leader enjoy a certain degree of economy of scale; bridges do not benefit from any of those at all.

Instead the kind of trade offs bridges are making limits scalability of the project as they are only allowed to serve a fraction of the actual total addressable market; they could almost never serve other part of the market given the tradeoffs they made

natively verified bridges are only limited to transfers within the pre determined ecosystems; like how IBC is only used to facilitates within the Cosmos ecosystem and the NEAR Rainbow Bridges does transfer between NEAR and Ethereum and canonical bridges could only work between rollups and Ethereum

natively verified bridges could even digest some of the demand for higher value transfer as they are more secured regardless the required time being slightly longer at more than 20 minutes on average

locally verified bridges like Hop Protocol could only facilitate transfer between Ethereum and its rollups; and its architecture does not allow further expansion beyond this narrowly defined addressable market

an exception might be Across Protocol which tries to expand its addressable market from Ethereum rollups primarily to EVM chains starting with Avalanche; but it still requires heavy engineering effort and the use of zero knowledge technology with the participation of Succinct Labs

externally verified bridges are less confined by the extensibility and generalizability problem; but the liquidity fragmentation once again makes scaling the scope of service a tough problem to solve

2. Business Model Bringing More Scalability Problem

Bridges with better extensibility are usually what we refer as third party bridges or liquidity bridges as above; which they front users with liquidity of the required assets from liquidity pools they run to shorten the waiting time required.

As liquidity bridges scale and grow to support more chains; they have to bootstrap liquidity pools for specific assets at every single chain; for instance

Stargate has to bootstrap ETH and USDC pool at every new destination; and the likes of newer rollups like Linea and Scroll has very thin liquidity;

Hop has to bootstrap hAsset pools also for each new destination chain; and as of now the protocol has 7 different separated liquidity ETH hETH pool at 7 rollups they are supporting with an average TVL of less than 4mn

similarly Connext only has less than 200k TVL in each of their USDC pool across major rollups and BNB Chain; only that on Gnosis has more than 2mn

This makes amassing liquidity for popular assets like $ETH and $USDC a continuous and troublesome effort as the protocol scales. What is worse is that this implied that liquidity bridges do not benefit from economy of scale.

If we think about the problem liquidity bridges are essentially solving; they are effectively offering a short term loans to users who are looking to transfer assets to slightly improve their experience by shortening the waiting time from 7-day (in the case of retrieving liquidity from optimistic rollups) to at most 5 minutes.

It functions as a money market protocol in some sense and liquidity as the names suggests become the center of the solution; and ironically bootstrapping liquidity becomes the biggest hurdle. It effectively becomes a structural problem for the entire vertical as token transfers come in different forms and sizes.

As we foresee more rollups launching in the future; existing bridges would find it extremely hard to keep up and extend connectivity; and a natural extension to the scalability issue is that users might face huge slippage in the case of low liquidity.

3. Potential Slippage Issues

Although third party bridges all work in slightly different ways; slippage would still be a problem to users for specific token bridges in the case of low liquidity especially when it involves the use of an intermediary assets like Hop and Synapse

Hop fronts users with liquidity in the form of hAssets at the destination chain and is subsequently swapped back to the native asset upon arrival; users would actually receive less tokens than they deposited if the hAsset pool has low liquidity as the AMMs are supposed to rebalance the pool;

Synapse face a similar issue as it creates liquidity pools for nexus assets such as sETH and sUSD; and assets are first swapped into nexus assets upon transfer and subsequently converted back to native assets at the destination

Better bridges designs in the market effectively removes the use of an intermediary asset or an AMM formula like how Across and Stargate does it; and hence both are offering more competitor slippage compared to its competitors for the time being

Across leverages third party relayers to front liquidity to users directly for each transfer; and subsequently pays off the short term loan from the liquidity hub on

Stargate directly front users liquidity directly from the pool as long as the destination chain receives the request of the token transfer through the underlying messaging architecture

4. Bridging Alternatives

As a corollary of the above problem; users seek alternatives bridging tokens from one chain to another and the cruel reality is that the market actually offers a handful of bridging alternatives which indirectly digest some of the real demand of using liquidity bridges

canonical bridges as mentioned above offer better security level; the downside is that it takes on average more than 20 minutes for the transfer to complete and the slippage is minimal but it could be the go to option for higher value transfer and users would not incur slippage as opposed to third party bridges

centralized exchanges could also function as token bridges; and most of them are supported by real time customer services and less limited by the destination and assets third party bridges could offer now

An interesting point to note from the market overview above is that demand for canonical bridges might actually be slightly skewed for the below reasons

double counting problem exists as third party bridge leverage canonical bridges to repay off chain actors for fronting liquidity; except Stargate which adopts a messaging focused approach that does not involve third party actually delivering the required tokens

airdrop farming concerns; as users deliberately interact with foundation operated canonical bridges for better exposure and odds as evidenced by the transfer volume through the zkSync Era bridge

Conclusion

Don’t get me wrong - I like bridges and the problem they are solving; and I also particularly enjoy spending time understanding how different bridges are solving problems with slightly difference approaches.

I just thought bridges are extremely tough to invest in as a vertical given how fragmented the market structure is and how a different solution could fit one niche market better but fail to serve another market given the trade off they have to make.